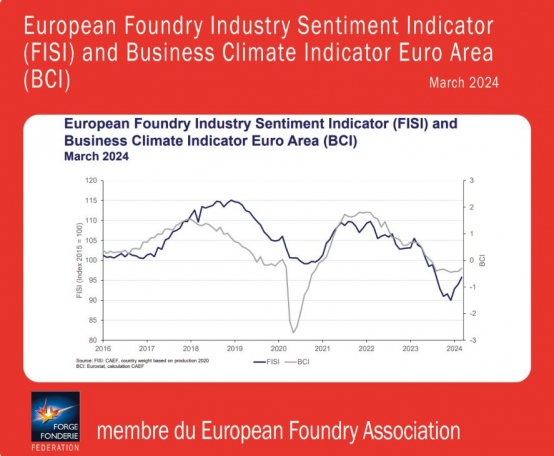

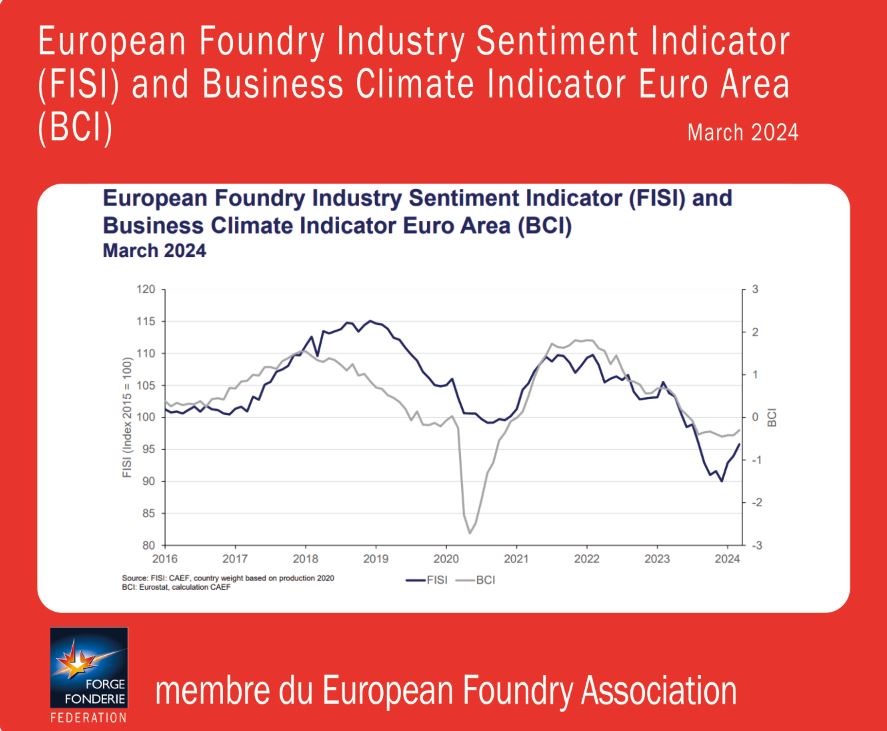

L’indice FISI (Foundry Industry Sentiment Indicator) est publié chaque mois par l’association européenne de fonderie EFF (ex-CAEF) à partir des réponses des organisations membres, dont la Fédération Forge Fonderie, sur le climat des affaires dans le secteur de la fonderie (fonte, acier et non-ferreux) à date et leurs attentes pour les six prochains mois.

Télécharger les résultats de l’indice FISI de mars 2024

En mars 2024, l’indice FISI a connu une nouvelle hausse, atteignant 95,8 points d'indice. Cette évolution reflète la troisième hausse consécutive de l'indice, qui enregistre une augmentation de 1,8 point, s'établissant à 95,8 contre 94,0 le mois précédent.

La tendance positive actuelle de l'industrie européenne de la fonderie peut être attribuée à deux facteurs clés, l'un statistique et l'autre économique. Premièrement, il semble que l'indice de confiance de l'industrie européenne de la fonderie ait atteint son niveau le plus bas au cours des derniers mois, ce qui indique un changement vers une trajectoire ascendante.

D'autre part, plusieurs fonderies européennes ont réduit leurs capacités de production au cours de l'année écoulée. Cette situation tendue tout au long de l'année 2023 a commencé à s'atténuer dans certaines régions, notamment en raison d'une réduction notable des prix des matières premières.

Globalement, l’industrie attend avec impatience un coup de pouce des décideurs politiques à Bruxelles, qui, cependant, ne pourrait pas se matérialiser avant l'automne, lorsque les nouveaux membres élus du Parlement européen et de la Commission prendront leurs fonctions. Dans l'intervalle, il est impératif que les acteurs du secteur restent vigilants et proactifs pour relever les défis actuels.

Dans le même temps, l’indice BCI a augmenté de façon notable et s'établit désormais à -0,30 point d'indice. C'est le neuvième mois consécutif que le BCI se maintient sous le seuil critique de 0 point d'indice. Cette tendance positive est principalement due à l'amélioration de l'évaluation des niveaux des carnets de commandes à l'exportation, mais elle reflète toujours les défis persistants dans ce domaine. En outre, les attentes en matière de prix de vente pour les mois à venir ont augmenté au cours des derniers mois et soutiennent l'augmentation de l'indice de confiance.

Source : traduction du communiqué de presse EFF

(*) Indice BCI : Business Climate Indicator. Indice de l’évolution du secteur manufacturier en zone euro publié par la Commission européenne à partir d’enquêtes sectorielles (tendances de la production ; carnets de commandes ; carnets de commandes à l'exportation ; stocks ; attentes en matière de production).

| News |

|

|

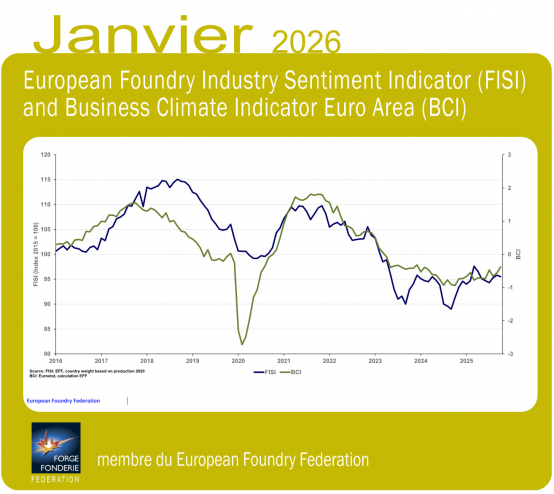

March 3 2026

The European Foundry Industry Sentiment Index (FISI) in January 2026

The European foundry industry has begun a new year of 2026 with a slight correction of the

The Business Climate Index (BCI), published by the European Commission, reached -0.38 in Additional information at eff-eu.org |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice