| 7,5 billion € turnover |

35 920 people |

1,870 million tons |

403 production sites |

(in volume)

|

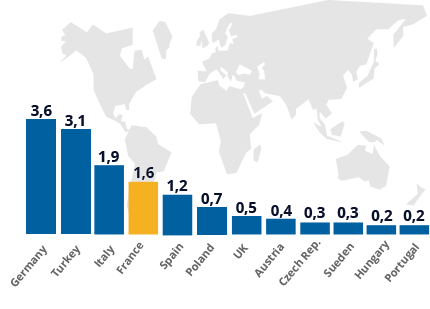

European ranking (Turkey included) by countries for Casting

|

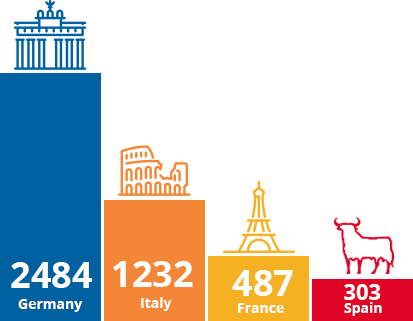

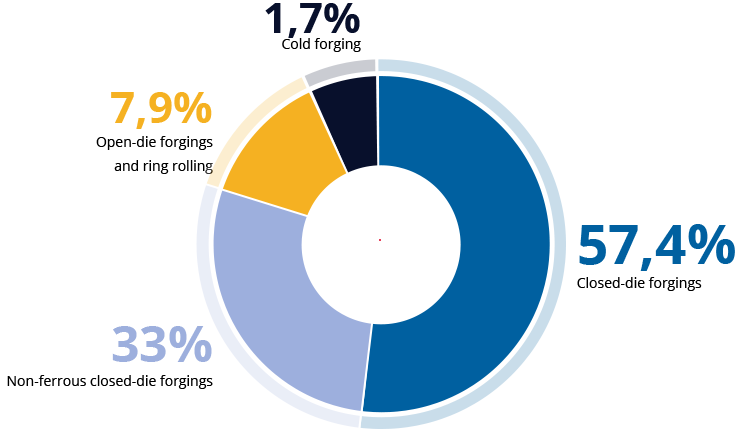

Forging production

|

| 5,7 billion € turnover |

28 507 people |

1,423 million tons de produits |

330 production sites |

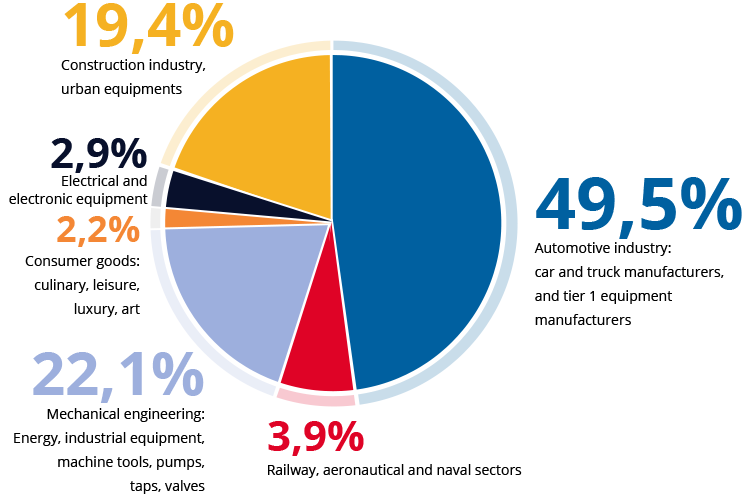

(% of turnover)

(% of tonnage)

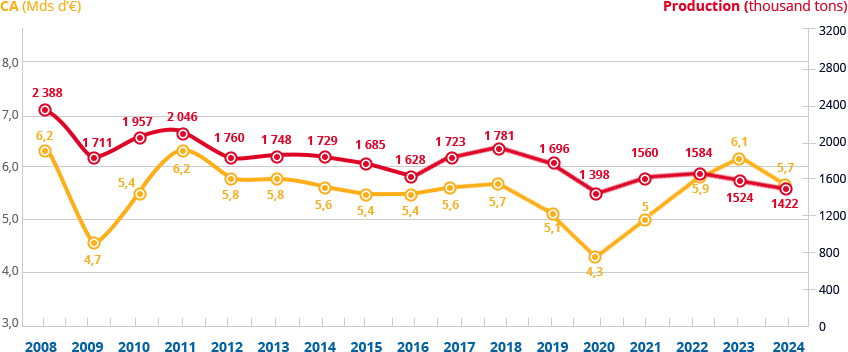

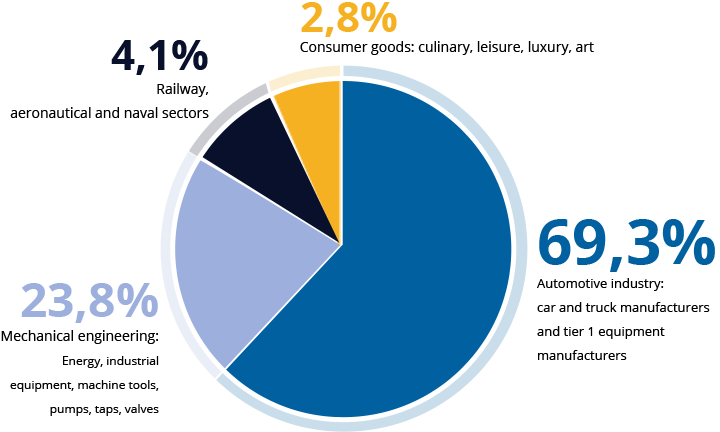

(billion € and thousand tons)

| 1,8 billion € turnover |

7 413 people |

447 thousand tons |

73 production sites |

(% of turnover)

(% of tonnage)

(billion € and thousand tons)

| News |

|

|

January 29 2026

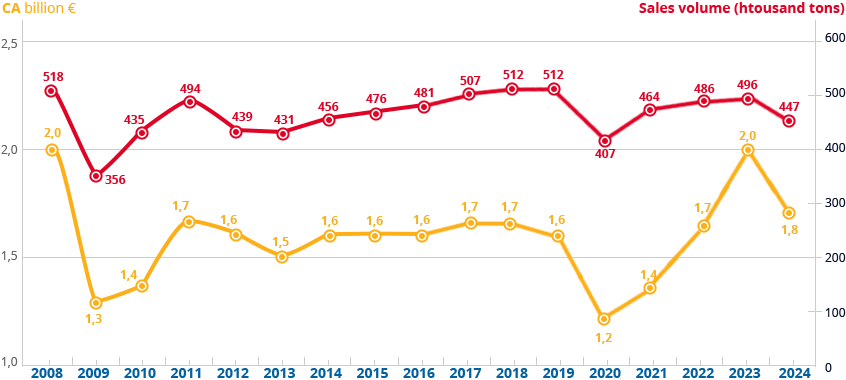

European Foundry Industry Sentiment in december 25

The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. December 2025: The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points. The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment.

The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz The European Foundry Industry Sentiment Index (FISI) increased in December 2025. The European foundry industry ended the year 2025 with a slight upside. The European Foundry Industry Sentiment Index (FISI), published monthly by European Foundry Federation, increased by 0.5 point in December 2025 and reached a level of 95.8 points.

The situation on the cast iron market in the main European markets was at a similar level as a month earlier, but it is worth noting that expectations for the next 6 months, in particular on the German market, are relatively optimistic. The situation is similar on the steel casting market. The German market showed an increase in production compared to November 2025 and such a trend is also planned for the next half of the year. In the other EFF member countries, the situation on the steel castings market has not changed compared to November. Taking into account the market of non-ferrous metal castings, the current situation in EFF member countries and expectations for the next 6 months are quite positive. It is worth noting that the foundry markets in Italy and Germany anticipate an increase in the production of castings made of this material. In the other countries participating in the survey, the expected level of production will be at a similar level as in previous months. The Business Climate Index (BCI), published by the European Commission, reached ‑0.56 in December 2025, compared to the previous reading of ‑0.66 in November 2025. The Eurozone Manufacturing PMI in December 2025 reached a level of 48.8 which was a decrease by 0.9 point from the value of 49.7 in November 2025. The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF — European Foundry Federation every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Purchasing Managers’ Index (PMI) - in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. EFF Contact: Witold Dobosz |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice