Pour avoir plus d'information sur notre site

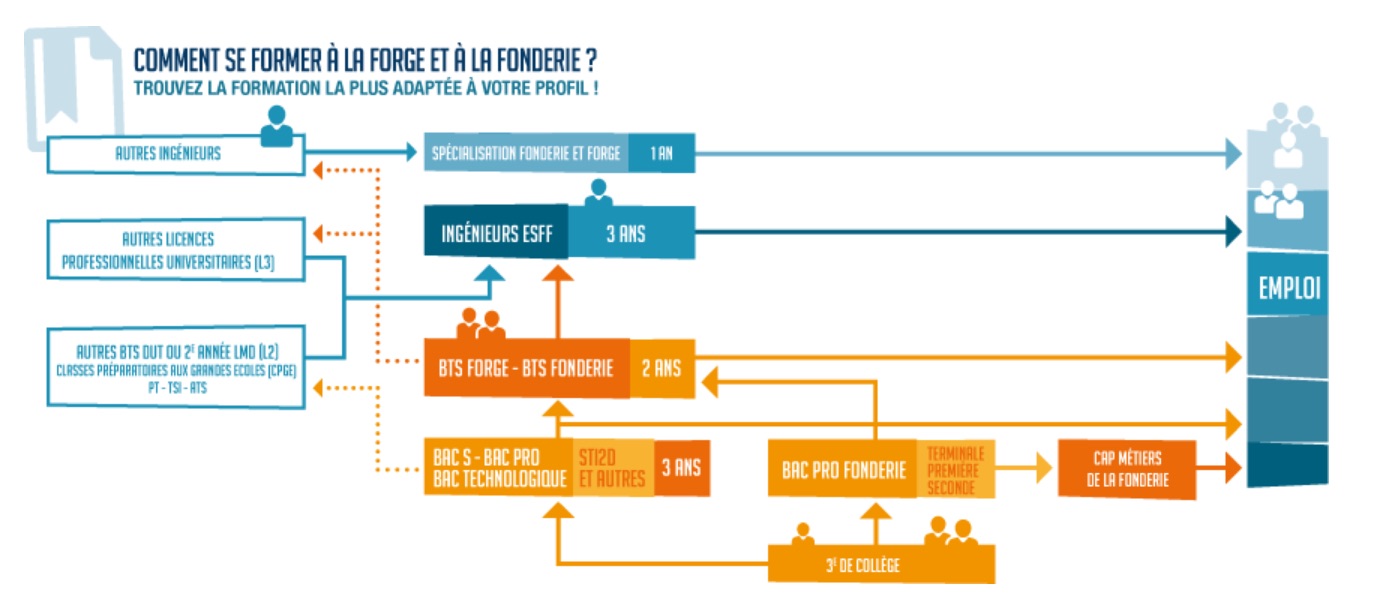

Découvrez nos formations :

JOURNÉES PORTES OUVERTES 2024

Lycée François Bazin

145, avenue Charles de Gaulle - 08000 CHARLEVILLE MEZIERES

03 24 56 81 56

Vendredi 16 février 2024 de 16h30 à 19h30

Samedi 17 février 2024 de 09h à 12h

Lycée Henri Brisson

25 avenue Henri Brisson - 18104 VIERZON

02 48 52 74 00

Samedi 17 février 2024 de 9h à 16h

Lycée Jean Prouvé

53, rue de Bonsecours - 54000 NANCY

03 83 35 25 73

Vendredi 22 mars 2024 de 13h30 à 17h30

Samedi 23 mars 2024 de 9h00 à 12h00

Lycée Loritz

29 rue des jardiniers - 54042 NANCY Cedex

03 83 36 75 42

Samedi 17 février 2024 de 9h00 à 16h00

Lycée Gustave Eiffel

96, rue Jean Lebleu - 59427 ARMENTIERES

03 20 48 43 43

Samedi 27 janvier 2024 de 9h00 à 16h30

Lycée Marie Curie

47, Boulevard Pierre de Coubertin - 60180 NOGENT SUR OISE

03 44 74 31 31

Samedi 17 février 2024 de 9h à 16h30

Lycée Hector Guimard

23, rue Claude Veyron - 69361 LYON Cedex 07

04 72 71 50 00

Samedi 3 février 2024 de 9h à 12h

Lycée Jean-Baptiste Colbert

197 avenue des Alliers - BP41 - 76141 LE PETIT QUEVILLY

02 35 72 69 11

Samedi 23 Mars 2024 de 9h à 12h

crédit photo : FOTOLIA

| News |

|

|

April 29 2025

The new issue of forge fonderie magazine is out!

Au sommaire: EDITORIAL : Confession d’un enfant du siècle dernier au pays de l’IA, Wilfrid BOYAULT

TECHNIQUE : IA générative pour la Forge et la Fonderie ÉVÉNEMENT :

FORMATION :

AGENDA : Les rendez-vous de la profession |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice