L’indice FISI (Foundry Industry Sentiment Indicator) est publié chaque mois par l’association européenne de fonderie EFF (ex-CAEF) à partir des réponses des organisations membres, dont la Fédération Forge Fonderie, sur le climat des affaires dans le secteur de la fonderie (fonte, acier et non-ferreux) à date et leurs attentes pour les six prochains mois.

Télécharger les résultats de l’indice FISI de juin et de juillet 2024

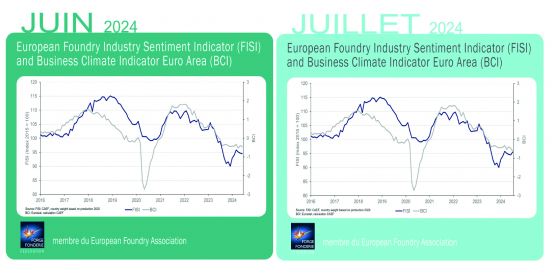

Après trois mois consécutifs de légère baisse, l’indice FISI s’établissait à 94,5 points en juin avant de remonter à 95,5 points en juillet, proche de son niveau au mois de mars 2024. Bien que cette augmentation soit la bienvenue, cette tendance est à prendre avec prudence. L'environnement économique général reste complexe et l'industrie de la fonderie continue à faire face à des défis importants.

Tout d’abord la plupart des économies des grands pays européens connaissent une phase de stagnation même si l’on observe depuis juillet quelques signes de reprise, notamment dans le secteur automobile et donc pour les fonderies européennes concernées.

Par ailleurs, l’industrie européenne reste confrontée à un niveau d’incertitude important, alimenté par les tendances imprévisibles du marché et les hésitations des investisseurs, même si l’on observe là aussi un léger soulagement et des perspectives moins incertaines qu’attendues initialement.

Il faut enfin souligner le rôle important des subventions accordées aux fonderies de pays tiers leur permettant de réduire leurs coûts par rapport à leurs homologues situées en Union européenne.

Dans le même temps, l'indice BCI a connu un léger déclin, passant de -0,39 à -0,46 points en juin puis -0,61 en juillet, restant depuis 11 moins sous le seuil critique de 0 point d'indice, ce qui reflète les difficultés persistantes de l'environnement des entreprises.

Sa récente baisse peut être attribuée à plusieurs facteurs. Tout d'abord, il y a eu une décélération des indicateurs de production, qui avaient précédemment montré des signes d'amélioration. Deuxièmement, les niveaux des carnets de commandes sont préoccupants, notamment à l’exportation face aux incertitudes persistantes dans la dynamique du commerce international. Enfin des incertitudes entourent la prochaine Commission européenne et les changements potentiels liés aux résultats des élections européennes qui, selon les pays, peuvent créer un environnement incertain et freiner les investissements.

Source : Traduction des communiqués CAEF (https://www.caef.eu/european-foundry-industry-sentiment-56/ et https://www.caef.eu/european-foundry-industry-sentiment-57/)

(*) Indice BCI : Business Climate Indicator. Indice de l’évolution du secteur manufacturier en zone euro publié par la Commission européenne à partir d’enquêtes sectorielles (tendances de la production ; carnets de commandes ; carnets de commandes à l'exportation ; stocks ; attentes en matière de production).

| News |

|

|

January 15 2026

La nouvelle édition est disponible !

L’expertise et l’actualité de la profession Forge & Fonderie

Téléchargement gratuit ICI ou commande de la version papier ICI EDITORIAL L’année du courage et du retour au bon sens ? Wilfrid BOYAULT BREVES Fatigue Design La Fédération Forge Fonderie participe à Global Industrie Paris TECHNIQUE Le magnésium pour les applications spatiales Patrick HAIRY, Michel STUCKY, David MIOT-POLETTI et Thibaut BOUILLY Recyclabilite du ZAMAK dans les emballages Clotilde MACKE-BART ENVIRONNEMENT Défis et opportunités de l’électrification dans les forges et les fonderies Charlotte MOUGEOT MARCHÉ La relance mondiale de l’énergie nucléaire : des promesses au réalisme Guillaume KOZUBSKI FORMATION À la rencontre des jeunes talents de la fonderie Sergio DA ROCHA Organisation du Concours « Un des Meilleurs Ouvriers de France » Fonderie d’Art Sergio DA ROCHA ÉVÉNEMENT EUROFORGE : 24. International Forging Congress Olivier VASSEUR AGENDA Les rendez-vous de la profession |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice